1031 Fall-Back

Copyright © 2020 James B. Wootton

What can the seller do if suitable replacement property may not be identified within 45 days?

When suitable like-kind property is not identified, the funds held by the qualified intermediary are scheduled to be immediately released to the seller, creating a large tax liability due for the same year. This happens to almost 25% of all intended 1031 transactions.

The solution starts by adding a simple clause to the original 1031 purchase and sale contract, or to the exchange agreement with the qualified intermediary, that if the 1031 exchange fails, then a Structured Sale can be implemented, at no expense or delay for the buyer.

If that happens, or even if part of the funds is used for replacement property, then the remainder (the boot) can be used in the Structured Sale process to defer the taxes by establishing a stream of guaranteed Installment payments over time, up to 30 years, all backed by guaranteed, fixed annuities or U.S. treasuries.

The main reason sellers avoid Installment Sales is the risk of buyer’s default. In addition, negotiating terms that are acceptable to both buyer and seller can be difficult. With the Structured Sale that risk is eliminated.

In a Structured Sale, the Qualified Intermediary instead transfers the cash to an Assignment Company which will pay the seller guaranteed periodic payments desired by the seller, all backed by guaranteed fixed annuities or U.S. treasuries.

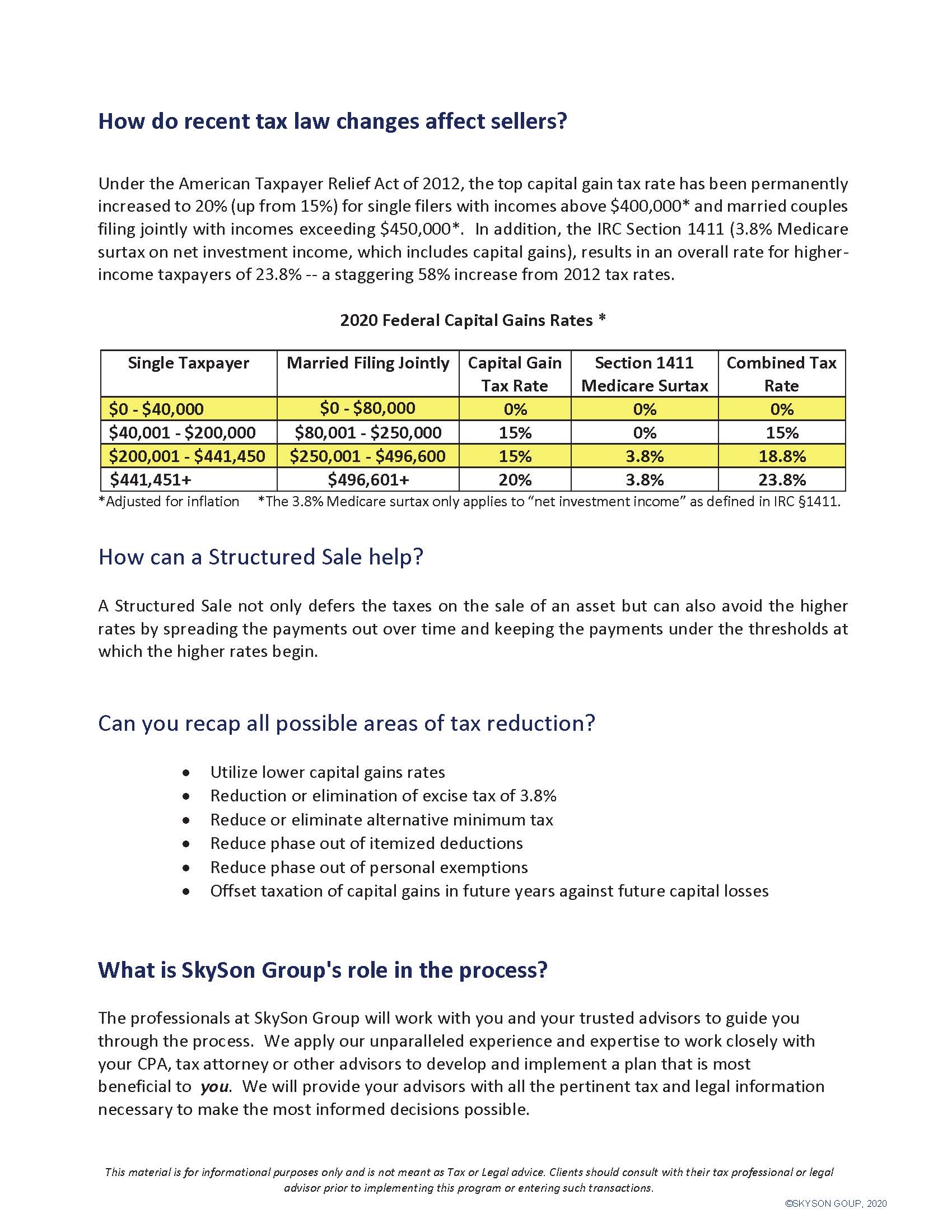

By deferring the payments, the 3.8% net investment income tax under IRC 1411 can be eliminated; the 4.8% Ohio state capital gains tax eliminated; the federal capital gains tax reduced from 20% to 15%; or in some cases, to zero.

Although the rate for U.S. treasuries is lower than potential market interest rates, when you factor in the result of investing 100% of the funds versus investing only 71.4% after-tax dollars, without risk of loss, the effective rate is very attractive indeed.

For more information contact:

James B. Wootton, Structured Sale Consultant

Tax Deferred Option

8405 Pulsar Pl Ste 157

Columbus, OH 43240

(614) 956-6125

jim@taxdeferredoption.com

Neither Standard Corporation DBA Tax Deferred Option nor James B. Wootton may or does provide tax or legal advice.

Interested parties should consult their legal, tax and investment advisers before participating in any transaction.